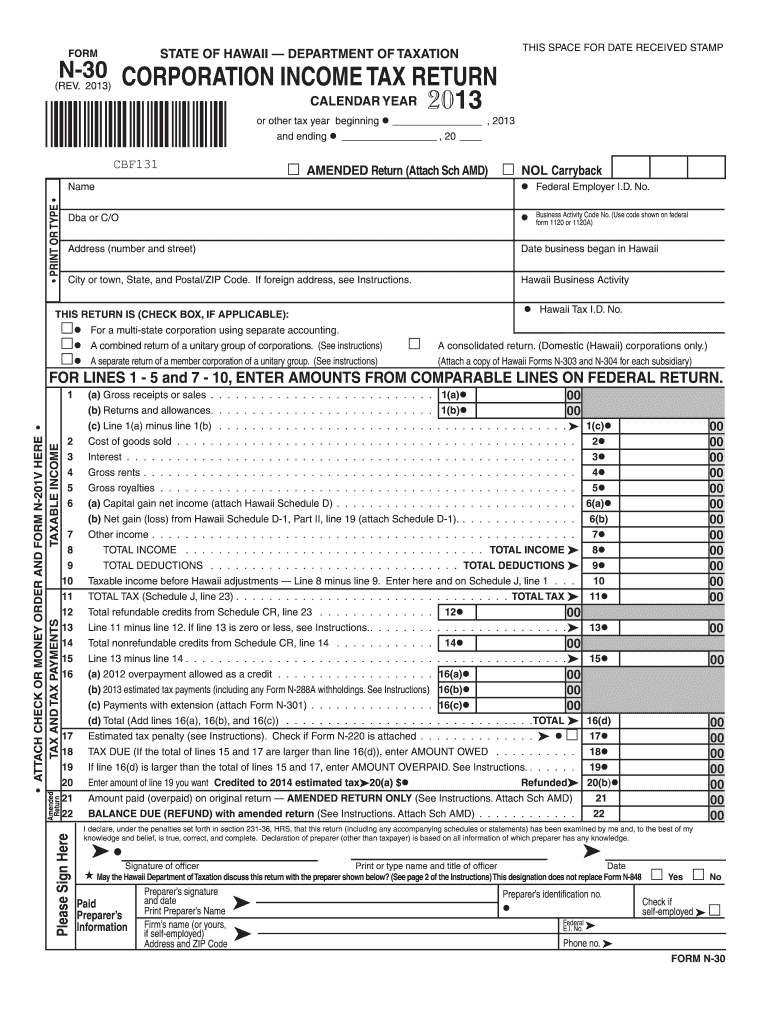

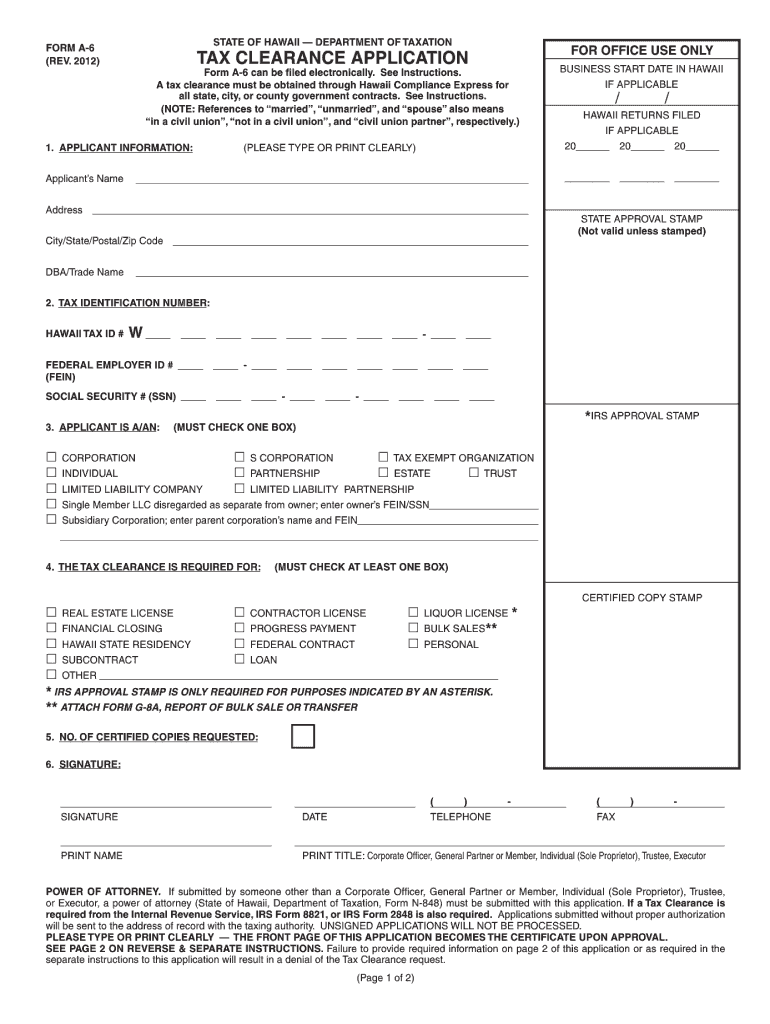

This interview originally aired on The Conversation on March 9, 2022. Click here for a list of events.Ĭlick here for the Federal Trade Commission's Consumer Information website. Hawaii SB1092 2022 Suspends the requirement for disposition of the conveyance tax to the land conservation fund and the rental housing revolving fund for fiscal year. Ige approved this measure on Jand it became Act 115, Session Laws of Hawaii 2022. 514 which provides a refund for resident taxpayers who file their 2021 individual tax return (Form N-11) on or before December 31, 2022. The department’s virtual Consumer Education Fair continues today through Friday. The 2022 Hawaii State Legislature passed S.B.

So I think that we have to be mindful of these kinds of scams, irrespective of what your age is." And then I will give you a paycheck, you deposit it, it bounces after you pay out monies to another company. "So they will fall for different kinds of scams, like they will fall for those kinds of paycheck scams of, 'I will hire you to start this new job' and 'You buy these products,' or whatever it is. "Millennials equally have the potential to fall prey to scams," Colón said.

CONVEYANCE TAX HAWAII 2022 PLUS

She said it’s information every consumer can use to protect themselves, because scammers aren’t just targeting seniors. increases Hawaii’s estate tax on Hawaii net taxable estates over Hawaii net taxable estate exceeds 5,000,000 to 1,385,000 plus 20 of the amount by which the Hawaii net taxable estate exceeds 10,000,000.

The DCCA is wrapping up a virtual Consumer Education Fair, and Colón said the free sessions can help protect consumers from identity theft, fraud schemes, and other scams. The Conversation’s Russell Subiono sat down with DCCA Director Catherine Awakuni Colón to talk about the pandemic’s impact on fraud, and what resources are available to keep you safe from scams. The Hawaiʻi Department of Commerce and Consumer Affairs is the state agency tasked with educating consumers and enforcing laws that protect them.

CONVEYANCE TAX HAWAII 2022 FULL

It’s a time set aside by federal and local governments to help people understand consumer rights and learn to avoid fraud and scams. The conveyance tax is payable on the actual and full consideration actually paid or ultimately required to be paid it is immaterial for purposes of the conveyance tax that the transfer or conveyance resulted in a gain or loss. The Hawaii estate tax is separate from the federal estate tax, which is imposed only on estates worth more than 12.92 million (for deaths in 2023).

0 kommentar(er)

0 kommentar(er)